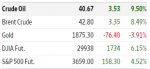

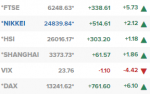

Records galore this week.

Apple @ $2T That's trillion with a T

S&P500 and NASDAQ set records

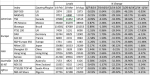

Lots of interesting charts, graphs, and data from the

blog of an NYU professor who studies valuations... For folks interested in corp. finance & valuation details, this blog is a really interesting read with loads of numbers crunched. Numbers below are as of 8/14:

View attachment 10313

On a personal note, we have '

Stayed the Course'. It was a tough few months watching / wondering / losing sleep over / worrying what would happen. Certainly there may still be rough waters ahead but we didn't panic and sell and we didn't panic and buy. We've both been blessed to be employed and keep doing EXACTLY (investing-wise) what we were doing before the crash in Feb/Mar. All of those things have helped (plus a lot of prayers for peace of mind regardless of what happened to us / the economy !).

My wife's company shares (ESPP etc. ) went down 75% over the course of a couple weeks from their February peak to their low in March. It's 'back' to down about 10% from February peak.

Overall, we are a good ways up from the crash value because everything we invested during Feb-March was acquired at such a low price. We're 75% equity / 25% bonds so bond value being high helps overall values, too (we're long holders so even if/when they go down, we'll just rebalance into bonds as necessary. We haven't had to rebalance (either way) but we're close based on our

Investment Policy Statement (IPS). Both bonds and stocks going up has negated the need so far.

The IPS helped us not panic because we had - ahead of time - determined our course based on a pretty thorough analysis and documented understanding of our risk tolerance, asset allocation dimensions, cash flow needs, long-term view, and horizon ... all of which allowed us to stay the course. I hope that we're not tested again anytime soon!