I wanted to up my equity allocation but my financial guide talked me out of it. Was he ever right! My portfolio actually went up a small bit yesterday....even with the tech stocks wiping out.

Personal Finance: Financial Planning & Investing

- Thread starter BamaNation

- Start date

-

HELLO AGAIN, Guest! We are back, live! We're still doing some troubleshooting and maintenance to fix a few remaining issues but everything looks stable now (except front page which we're working on over next day or two) Thanks for your patience and support! MUCH appreciated! --Brett (BamaNation) if you see any problems - please post them in the Troubleshooting board!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

if you're looking for safety, VMFXX, SPAXX, etc (money market funds) have 7-day SEC yields over 4%. Ally is 3.8% for savings. iBonds are over 3%.

For planning purposes, our long-term planning rate of return we estimate as 4%. Over last 10 years our actual annual rate has averaged 11.5% per year. Nearly triple our plan (with 80% equities, 20% fixed income. We moved this year to 75/25.)

What this relatively short period has taught us is that even with a couple of down years (-7% in 2018, -18% in 2022), and with 25% in bonds that have stunk up the joint the last few years, we're staying calm and staying the course as defined in our carefully considered Investment Policy Statement as we established in 2016.

Controlling what we can control (maxing tax-advantaged savings, saving/investing as much as possible, investing in a Bogleheads-worthy 3-fund portfolio, and not buying (too much) bling bling) is what we do. The markets (bond/equity/other) will do whatever they do with no input from us and the politicians will do whatever they do (again with no input from us).

We will also be de-risking some as defined in our IPS as we age because of the shorter runway to retirement. Otherwise, we will stay the course through the storms and the calm seas.

For planning purposes, our long-term planning rate of return we estimate as 4%. Over last 10 years our actual annual rate has averaged 11.5% per year. Nearly triple our plan (with 80% equities, 20% fixed income. We moved this year to 75/25.)

What this relatively short period has taught us is that even with a couple of down years (-7% in 2018, -18% in 2022), and with 25% in bonds that have stunk up the joint the last few years, we're staying calm and staying the course as defined in our carefully considered Investment Policy Statement as we established in 2016.

Controlling what we can control (maxing tax-advantaged savings, saving/investing as much as possible, investing in a Bogleheads-worthy 3-fund portfolio, and not buying (too much) bling bling) is what we do. The markets (bond/equity/other) will do whatever they do with no input from us and the politicians will do whatever they do (again with no input from us).

We will also be de-risking some as defined in our IPS as we age because of the shorter runway to retirement. Otherwise, we will stay the course through the storms and the calm seas.

Last edited:

If you're in or near retirement (or planning to be in retirement at some point in your life  ) ... this post on WhiteCoatInvestor.com today is a decent summary explanation of some popular portfolio withdrawal strategies.

) ... this post on WhiteCoatInvestor.com today is a decent summary explanation of some popular portfolio withdrawal strategies.

www.whitecoatinvestor.com

www.whitecoatinvestor.com

You may want to first read this article on the same site from September:

www.whitecoatinvestor.com

www.whitecoatinvestor.com

Which Retirement Withdrawal Strategy Is Best?Comparing Portfolio Withdrawal Strategies in Retirement | White Coat Investor

There are hundreds of methods for how to spend from a retirement portfolio. Let's go over a few of them to see what might work best for you.

You may want to first read this article on the same site from September:

A Framework for Thinking About Retirement Income | White Coat Investor

As you enter retirement, it's really important to have a framework in place. That will help with longevity risk when you're done working.

For anybody wondering why the stock market has taken such a huge hit despite the fact that there's nothing wrong with the economy, this is a perfect example of the saying: "The financial markets don't like bad news but they can handle it. What they can't handle is uncertainty."

And our government has created a whole bunch of uncertainty. Tariffs are levied. Then lifted. Then partially levied. Then threatened. Or not. To what end? When will they be lifted? Why are we doing this at all?

Ukraine is cut off from all aid. Then all aid plus satellite intel. Then intel gets restored. And maybe materiel aid too. Or not.

So what's the American foreign and/or fiscal policy? I don't know. I don't think anybody does. Anyway, even if you did understand those things right now, either or both could change by lunchtime tomorrow. Which creates all kinds of uncertainty...which the financial markets can't handle.

My recommendation: Make a disc with a bunch of possibilities on it. Pin it to your backyard fence so that it spins. Spin it real hard. Now put your forehead on the end of a baseball bat and turn 10 times. Now throw a dart at the spinning wheel. Your dart has as good a chance of being right as any Stanford PhD.

And our government has created a whole bunch of uncertainty. Tariffs are levied. Then lifted. Then partially levied. Then threatened. Or not. To what end? When will they be lifted? Why are we doing this at all?

Ukraine is cut off from all aid. Then all aid plus satellite intel. Then intel gets restored. And maybe materiel aid too. Or not.

So what's the American foreign and/or fiscal policy? I don't know. I don't think anybody does. Anyway, even if you did understand those things right now, either or both could change by lunchtime tomorrow. Which creates all kinds of uncertainty...which the financial markets can't handle.

My recommendation: Make a disc with a bunch of possibilities on it. Pin it to your backyard fence so that it spins. Spin it real hard. Now put your forehead on the end of a baseball bat and turn 10 times. Now throw a dart at the spinning wheel. Your dart has as good a chance of being right as any Stanford PhD.

Last edited:

Interesting article from Morningstar. Says that tariffs are financially dangerous but aren't the cause of the resent stock market pullback.

I don't know if Rekenthaler (the now-retired former director of research at Morningstar) is right or wrong, but he makes a logical case.

Tariffs Aren’t the True Cause of the Markets’ Selloff | Morningstar

I don't know if Rekenthaler (the now-retired former director of research at Morningstar) is right or wrong, but he makes a logical case.

Tariffs Aren’t the True Cause of the Markets’ Selloff | Morningstar

I tend to agree. I think several factors are involved in the recent selloff. The P/E ratio of the market is above historical norms, there may be a bit of a bubble in AI stocks and the first year of the presidential cycle is frequently the most difficult for stocks due to uncertainty over how a new administration will govern. In both January and February the market made new highs a couple of times but just barely, which can indicate a "tired" market and perhaps a market top. Normally a 10% correction occurs every 1-2 years and it's been a while. We have a bear market (20%+) decline about every 5 years. The last one of those was during the Covid scare of 2020, so here we are in 2025. My advice to anyone would be to not make investment decisions based on politics but instead have a portfolio allocated in a way where they can handle some declines without extreme anxiety.Interesting article from Morningstar. Says that tariffs are financially dangerous but aren't the cause of the resent stock market pullback.

I don't know if Rekenthaler (the now-retired former director of research at Morningstar) is right or wrong, but he makes a logical case.

Tariffs Aren’t the True Cause of the Markets’ Selloff | Morningstar

Your last sentence should be carved into the inside of every investor’s eyelids.I tend to agree. I think several factors are involved in the recent selloff. The P/E ratio of the market is above historical norms, there may be a bit of a bubble in AI stocks and the first year of the presidential cycle is frequently the most difficult for stocks due to uncertainty over how a new administration will govern. In both January and February the market made new highs a couple of times but just barely, which can indicate a "tired" market and perhaps a market top. Normally a 10% correction occurs every 1-2 years and it's been a while. We have a bear market (20%+) decline about every 5 years. The last one of those was during the Covid scare of 2020, so here we are in 2025. My advice to anyone would be to not make investment decisions based on politics but instead have a portfolio allocated in a way where they can handle some declines without extreme anxiety.

A good thought to keep in mind during volatile times, from The Oracle:

"The market is designed to transfer money from the active to the patient."

If you have one or more business cycles (7 - 9 years) left before retirement, and already have a diversified portfolio, don't just do something....stand there.

"The market is designed to transfer money from the active to the patient."

If you have one or more business cycles (7 - 9 years) left before retirement, and already have a diversified portfolio, don't just do something....stand there.

Something of a repeat of my post from March 18, along with something to consider.

Thinking about all the nastiness in the financial markets. We can yell and curse and stomp feet and burp about what's causing it, whose fault it is, and who to blame until we're blue. It won't help. What will help is rational decision-making.

If you're one or more business cycles away from retirement, put cotton in your ears and keep on keeping on. As another poster characterized this philosophy, "Keep calm and invest on."

The most successful investor of our time (maybe all time) is Warren Buffett. One of his great quotes is, "The market is designed to transfer money from the active to the patient."

So be a patient recipient of the market's largesse.

For those closer to retirement, or in retirement, here's something to consider: Convert some or all of your Traditional IRAs to Roth IRAs.

Here's the deal: In Traditional IRAs, contributions are in pre-tax dollars, but you pay tax on withdrawals. In Roth IRAs, the contributions are in post-tax dollars, but withdrawals -- even if there are massive gains since the contribution -- are tax-free.

The reason it might be a good time to convert is that you have to pay tax on the conversion now. Which sounds counterintuitive.

But you have to pay tax on withdrawals from Traditional IRAs anyway. And because today's market, especially the tech sector, is down significantly, the amount of the tax you incur in the conversion to Roth might be less than what you'd pay on Traditional withdrawals in the future. Since you'd be converting at a down time, you stand to gain a lot -- tax free -- when the market comes back.

And it will come back. So this is a twist on buying low and selling high.

Now, everybody's tax situation is different. One size definitely does NOT fit all. There could be reasons specific to you that this isn't a good idea. There could be reasons it's a great idea.

Regardless, it's definitely worth asking the question. Talk with your financial advisor and make the right decision for you.

Whether you decide to convert or not, you're making a conscious decision and taking control of your situation.

Thinking about all the nastiness in the financial markets. We can yell and curse and stomp feet and burp about what's causing it, whose fault it is, and who to blame until we're blue. It won't help. What will help is rational decision-making.

If you're one or more business cycles away from retirement, put cotton in your ears and keep on keeping on. As another poster characterized this philosophy, "Keep calm and invest on."

The most successful investor of our time (maybe all time) is Warren Buffett. One of his great quotes is, "The market is designed to transfer money from the active to the patient."

So be a patient recipient of the market's largesse.

For those closer to retirement, or in retirement, here's something to consider: Convert some or all of your Traditional IRAs to Roth IRAs.

Here's the deal: In Traditional IRAs, contributions are in pre-tax dollars, but you pay tax on withdrawals. In Roth IRAs, the contributions are in post-tax dollars, but withdrawals -- even if there are massive gains since the contribution -- are tax-free.

The reason it might be a good time to convert is that you have to pay tax on the conversion now. Which sounds counterintuitive.

But you have to pay tax on withdrawals from Traditional IRAs anyway. And because today's market, especially the tech sector, is down significantly, the amount of the tax you incur in the conversion to Roth might be less than what you'd pay on Traditional withdrawals in the future. Since you'd be converting at a down time, you stand to gain a lot -- tax free -- when the market comes back.

And it will come back. So this is a twist on buying low and selling high.

Now, everybody's tax situation is different. One size definitely does NOT fit all. There could be reasons specific to you that this isn't a good idea. There could be reasons it's a great idea.

Regardless, it's definitely worth asking the question. Talk with your financial advisor and make the right decision for you.

Whether you decide to convert or not, you're making a conscious decision and taking control of your situation.

Last edited:

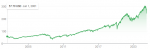

I think perspective and pictures really help here. Here's the complete VTI (Vanguard total stock market index) since its creation 24 years ago. Stay the course. Probably a good time to again point you to the Personal Finance sub-menu at the top right of the page which points to a bunch of specific topics we've had in this series. Thanks to 4Q and others for providing depth, insight, and calming voices amidst the bull and bear runs over the 6 years that we've had this series.

ALSO, this could be a GREAT time to simplify your holdings by selling funds/stocks that are currently at a loss and immediately reinvesting in an index fund (not the same fund but one that is similar), harvesting the loss (Tax Loss Harvesting or TLH), and using that loss to reduce your taxes for 2025 and/or in the future. I talked about something like this in my Complexity vs Simplicity post a few years back. This may be particularly useful for inherited funds / individual stocks and/or high-expense funds that you've been wanting to change.

ALSO, this could be a GREAT time to simplify your holdings by selling funds/stocks that are currently at a loss and immediately reinvesting in an index fund (not the same fund but one that is similar), harvesting the loss (Tax Loss Harvesting or TLH), and using that loss to reduce your taxes for 2025 and/or in the future. I talked about something like this in my Complexity vs Simplicity post a few years back. This may be particularly useful for inherited funds / individual stocks and/or high-expense funds that you've been wanting to change.

Last edited:

Here's another chart showing treasury yields. To quote the WSJ article where I found this, "bond traders are reflexively pricing in the simplest scenarioâ€â€a short-term economic shock followed by a rapid return to the status quo."

Whether this is the case or not will be proved out in the coming weeks, but that's what the "smart money" is doing. Things may change rapidly intra-day or intra-week. But longer-term, I'm "betting" this way too by staying the course.

Whether this is the case or not will be proved out in the coming weeks, but that's what the "smart money" is doing. Things may change rapidly intra-day or intra-week. But longer-term, I'm "betting" this way too by staying the course.

The current volatility in the equity and debt markets is a great illustration of an old adage: "The markets can handle bad news. They don't like it, but they can handle it. What they can't handle is uncertainty."

It's true that nothing is ever 100% certain. But there's a base level of "life happens" uncertainty just built in. It's when you inject uncertainty that is materially greater than the inherent level that you get problems. It's especially bad if it's injected quickly as opposed to over time.

That's what we have now -- a massive wave of uncertainty injected ex cathedra, all at once, for reasons that have nothing to do with the underlying economy's fundamentals. Are tariffs for real? Are they a bluff? Is someone (or a group of someones) intentionally manipulating the markets? What in the world is the reasoning behind this? Will things get back to normal? Even if they do for a while, could these morons do it again (or something else equally illogical) and this mess raises its head in the future? How is it even possible to plan for the future?

That's a lot of well-founded uncertainty, all coming in just the last few weeks.

Why this is happening, I don't know. I'm not sure even the perpetrators know. It makes no sense whatsoever.

I have re-visited my original position on pointing fingers and yelling and stomping. I initially thought that was a futile exercise, and our energy would be better spent doing other things.

I now think it might actually help in that it can focus the DC political streetwalkers (which is all of them regardless of their political party, personal plumbing, skin color, or preferred characteristics of a life partner) on their chances for re-election.

Still, that's a question for the ballot box and doesn't help your investment portfolio today. So what should you do now? Likely nothing.

The rest of this post, including the closing sentence, is an excerpt from a WSJ newsletter:

It's true that nothing is ever 100% certain. But there's a base level of "life happens" uncertainty just built in. It's when you inject uncertainty that is materially greater than the inherent level that you get problems. It's especially bad if it's injected quickly as opposed to over time.

That's what we have now -- a massive wave of uncertainty injected ex cathedra, all at once, for reasons that have nothing to do with the underlying economy's fundamentals. Are tariffs for real? Are they a bluff? Is someone (or a group of someones) intentionally manipulating the markets? What in the world is the reasoning behind this? Will things get back to normal? Even if they do for a while, could these morons do it again (or something else equally illogical) and this mess raises its head in the future? How is it even possible to plan for the future?

That's a lot of well-founded uncertainty, all coming in just the last few weeks.

Why this is happening, I don't know. I'm not sure even the perpetrators know. It makes no sense whatsoever.

I have re-visited my original position on pointing fingers and yelling and stomping. I initially thought that was a futile exercise, and our energy would be better spent doing other things.

I now think it might actually help in that it can focus the DC political streetwalkers (which is all of them regardless of their political party, personal plumbing, skin color, or preferred characteristics of a life partner) on their chances for re-election.

Still, that's a question for the ballot box and doesn't help your investment portfolio today. So what should you do now? Likely nothing.

The rest of this post, including the closing sentence, is an excerpt from a WSJ newsletter:

|

|

|

Last edited:

If the tariffs isolate & expose China for who they really are, even unintentionally, and it forces them to uncharacteristically capitulate, then that will be a good thing and worth the short-term pain. Given typical Chinese views on saving face, I don't have much hope in this being what happens. If tariffs are the impetus of reordering the underpinning of the US economy, probably not so good. But, @4Q Basket Case , you're spot on in that the uncertainty is what is stoking the sell side. That and being able to get 4+% in "risk-free" treasuries. "Why buy into the market uncertainty if I have a sure thing in treasuries risk-free?" That's the mantra for the traders. We aren't traders, we're investors so...

While past performance is no predictor of future results, it does give perspective. Perspective is what we (I) need right now. If you're selling because of short-term actions / policies, you're probably not cut out for market investing, IMHO.

Charts give lots of perspective. Here's the last 25+ years S&P chart with the 1999-2001 dot bomb, 2007-2009 global financial crisis, 2020-2021 Corona, and April 2025. Nothing is certain through any of these events except that with time & perspective, the line keeps moving toward the upper right. You just have to have the nerves and calmness to don't just do something, but stand there and stay the course.

On a personal note, we had been contemplating what to do with cash from recent dividends in our brokerage & Roth accounts. Going against my own advice of not timing the market, I was waiting to see what happened with the tariffs. Market kept moving down and I was expecting it to keep moving down for a few more days. Then it spiked on Wednesday and I paid 7% more than I would have on Monday if I hadn't been indecisive.

Additionally, yesterday, I was continuing to put some remaining dividends to work as the market was down 2% and a short few hours later it was up 3% so I made 5% on what I invested yesterday.

The story for me is to not try to time the market - time IN the market is better than TIMING the market.

As they say, Nobody knows nothing. If they tell you they do, they're lying. So, don't try to predict anything. Just invest for the long term and one daily move of -5-8% won't even matter 20 years from now. But being in the market at your desired asset allocation on the day it goes up +5-8% really will matter.

While past performance is no predictor of future results, it does give perspective. Perspective is what we (I) need right now. If you're selling because of short-term actions / policies, you're probably not cut out for market investing, IMHO.

Charts give lots of perspective. Here's the last 25+ years S&P chart with the 1999-2001 dot bomb, 2007-2009 global financial crisis, 2020-2021 Corona, and April 2025. Nothing is certain through any of these events except that with time & perspective, the line keeps moving toward the upper right. You just have to have the nerves and calmness to don't just do something, but stand there and stay the course.

On a personal note, we had been contemplating what to do with cash from recent dividends in our brokerage & Roth accounts. Going against my own advice of not timing the market, I was waiting to see what happened with the tariffs. Market kept moving down and I was expecting it to keep moving down for a few more days. Then it spiked on Wednesday and I paid 7% more than I would have on Monday if I hadn't been indecisive.

Additionally, yesterday, I was continuing to put some remaining dividends to work as the market was down 2% and a short few hours later it was up 3% so I made 5% on what I invested yesterday.

The story for me is to not try to time the market - time IN the market is better than TIMING the market.

As they say, Nobody knows nothing. If they tell you they do, they're lying. So, don't try to predict anything. Just invest for the long term and one daily move of -5-8% won't even matter 20 years from now. But being in the market at your desired asset allocation on the day it goes up +5-8% really will matter.

Last edited:

Since the market is down right now I'll bring up the practice of rebalancing a portfolio periodically. If the recent drop has caused an investor's portfolio to have 5-10% less in stocks than they normally would then it makes sense to buy the market right now to get the stock portion of the portfolio back to where it was. During times when the market is soaring and the stock portion becomes higher than normal an investor would sell some stocks to get it back down to a normal allocation again. By doing that an investor is always buying a little when stocks are low and selling a little when stocks are high. This works perfectly in any tax-deferred account where there are no tax consequences. In a taxable account an investor needs to calculate how much tax is involved in rebalancing.

... annnnd we're back above the S&P level prior to "Liberation Day." Still down a couple % YTD. Who knows what will happen good/bad in days/weeks/years ahead, but yet another example for me of "just don't do something, stand there" to Stay the Course !

If you Tax Loss Harvested equities on Apr 2-3 you're up ~10% in a month. Yet again, another reason to know what our allocation risk tolerance is and stick to it and rebalance / TLH when necessary.

Refer back to what 4Q posted from Jason Zweig's article, too!

(BTW, a great podcast interview recently with Zweig on the Bogleheads on Investing podcast. I recommend listening to ALL of the BHOI episodes. GREAT interviews in a non-hype way. Rick Ferri is the host and has written several books, is a board member of the John C Bogle Center for Financial Literacy and has his own fee-only advising practice. He's solid and sort of the opposite of the current sleazy crop of idiot/hype/meme financial gurus.)

If you Tax Loss Harvested equities on Apr 2-3 you're up ~10% in a month. Yet again, another reason to know what our allocation risk tolerance is and stick to it and rebalance / TLH when necessary.

Refer back to what 4Q posted from Jason Zweig's article, too!

(BTW, a great podcast interview recently with Zweig on the Bogleheads on Investing podcast. I recommend listening to ALL of the BHOI episodes. GREAT interviews in a non-hype way. Rick Ferri is the host and has written several books, is a board member of the John C Bogle Center for Financial Literacy and has his own fee-only advising practice. He's solid and sort of the opposite of the current sleazy crop of idiot/hype/meme financial gurus.)

WSJ had an interesting article today on the perception split between red & blue political leanings of investors. I couldn't care less who you voted for or why ... and that's not pertinent to this series.

BUT the point of the article really does matter ... and that is it really doesn't matter who is in charge, you're better off buying and holding for the long term:

If that's not motivation to leave your politics (worries, glee, gloom, or giddiness) at home when you decide how you're going to invest, I don't know what is.

BUT the point of the article really does matter ... and that is it really doesn't matter who is in charge, you're better off buying and holding for the long term:

wsj.com said:Investing $1,000 upon President Dwight Eisenhower’s inauguration in 1953, and holding only when a Republican was president, would produce about $29,000 today, according to Paul Hickey at Bespoke Investment Group. The same sum held only during subsequent Democratic administrations would be worth more than double that. Simply buying and holding would have yielded around $1.9 million.

If that's not motivation to leave your politics (worries, glee, gloom, or giddiness) at home when you decide how you're going to invest, I don't know what is.

I agree. CEO's of companies are usually able to adjust to whatever policy changes occur when the balance of power shifts in D.C. and are able to make profits regardless, thus pushing the stock market higher over time. I think bad decisions by the federal reserve have probably cause more recessions and stock market declines than politicians have. Typical mistakes by the federal reserve are to either raise interest rates too much or wait too long to start cutting them.WSJ had an interesting article today on the perception split between red & blue political leanings of investors. I couldn't care less who you voted for or why ... and that's not pertinent to this series.

BUT the point of the article really does matter ... and that is it really doesn't matter who is in charge, you're better off buying and holding for the long term:

If that's not motivation to leave your politics (worries, glee, gloom, or giddiness) at home when you decide how you're going to invest, I don't know what is.

The Roth IRA effect ...

Mrs. BN and I were talking about things we "didn't" do early on. One thing we would change is to make sure we contributed the max to Roths in those first years it was available.

This table (produced by chatgpt for me) shows the year, total stock market return for the year, the individual "pre-age-50" Roth contribution limit and the 2025 market value of that contribution for that year. (I'm using total market return because, in most scenarios, you should have your highest expected return asset in your Roth. For us it is a total stock market fund.) You can see that if one had contributed the max to Roth each year since Roth began in 1997, one would have nearly $500k today having only contributed $130k in total over nearly 30 years. I told her we weren't going to fret over what we didn't do early on but use this as a motivating factor for our kids !

We started our older daughter - who is nearly 19 now - in a Roth account when she earned a few hundred bucks in a school internship 3 summers ago. She worked as a lifeguard last summer and earned a couple of thousand. She has done some behind the scenes work for TideFans, as well. The Bank of Daddy matched her earnings into her checking/savings account and she then contributed all of her earnings each of those years into a Roth and now has a sizeable jump on saving for retirement and can see tangible results of saving/investing for retirement that she will hopefully continue herself as she matriculates toward graduation and a career. Also, she's currently on a full tuition scholarship at a Top 20 university so all of the excess $ (up to $35K) we will have saved for her college costs in a 529 plan can be converted into her Roth after graduation in a few years. But it all starts with saving early and often - something we didn't do early and now have to do often

Sure, you have to earn to save and you have to save to earn the result. The lesson for me is very clear... at a minimum we should have (and all need to) max contribute to our 401k up to at least the amount matched by employers and to max contribute to Roth (directly or via backdoor, or mega backdoor) and let that Roth grow without being taxed after the contribution and never be taxed upon withdrawal. (other caveats like don't max out credit cards, don't buy bling-bling, don't buy unneeded cars, don't buy too much house, etc. etc. etc. are also hard lessons learned).

Anyway, thought this was insightful and wanted to share with the group.

Mrs. BN and I were talking about things we "didn't" do early on. One thing we would change is to make sure we contributed the max to Roths in those first years it was available.

This table (produced by chatgpt for me) shows the year, total stock market return for the year, the individual "pre-age-50" Roth contribution limit and the 2025 market value of that contribution for that year. (I'm using total market return because, in most scenarios, you should have your highest expected return asset in your Roth. For us it is a total stock market fund.) You can see that if one had contributed the max to Roth each year since Roth began in 1997, one would have nearly $500k today having only contributed $130k in total over nearly 30 years. I told her we weren't going to fret over what we didn't do early on but use this as a motivating factor for our kids !

We started our older daughter - who is nearly 19 now - in a Roth account when she earned a few hundred bucks in a school internship 3 summers ago. She worked as a lifeguard last summer and earned a couple of thousand. She has done some behind the scenes work for TideFans, as well. The Bank of Daddy matched her earnings into her checking/savings account and she then contributed all of her earnings each of those years into a Roth and now has a sizeable jump on saving for retirement and can see tangible results of saving/investing for retirement that she will hopefully continue herself as she matriculates toward graduation and a career. Also, she's currently on a full tuition scholarship at a Top 20 university so all of the excess $ (up to $35K) we will have saved for her college costs in a 529 plan can be converted into her Roth after graduation in a few years. But it all starts with saving early and often - something we didn't do early and now have to do often

Sure, you have to earn to save and you have to save to earn the result. The lesson for me is very clear... at a minimum we should have (and all need to) max contribute to our 401k up to at least the amount matched by employers and to max contribute to Roth (directly or via backdoor, or mega backdoor) and let that Roth grow without being taxed after the contribution and never be taxed upon withdrawal. (other caveats like don't max out credit cards, don't buy bling-bling, don't buy unneeded cars, don't buy too much house, etc. etc. etc. are also hard lessons learned).

Anyway, thought this was insightful and wanted to share with the group.

| Year | Total Market Return (%) | Roth IRA Limit ($) | 2025 Value of Contribution ($) |

|---|---|---|---|

1997 | 31 | $ 2,000.00 | $ 16,411.00 |

1998 | 24 | $ 2,000.00 | $ 13,234.68 |

1999 | 20.9 | $ 2,000.00 | $ 10,946.80 |

2000 | -10.6 | $ 2,000.00 | $ 12,244.74 |

2001 | -13 | $ 2,000.00 | $ 14,074.41 |

2002 | -22.1 | $ 3,000.00 | $ 27,100.93 |

2003 | 28.7 | $ 3,000.00 | $ 21,057.44 |

2004 | 10.9 | $ 3,000.00 | $ 18,987.77 |

2005 | 4.9 | $ 4,000.00 | $ 24,134.44 |

2006 | 15.8 | $ 4,000.00 | $ 20,841.49 |

2007 | 5.5 | $ 4,000.00 | $ 19,754.97 |

2008 | -37 | $ 5,000.00 | $ 39,196.36 |

2009 | 28.7 | $ 5,000.00 | $ 30,455.60 |

2010 | 17.1 | $ 5,000.00 | $ 26,008.20 |

2011 | 1 | $ 5,000.00 | $ 25,750.69 |

2012 | 16 | $ 5,000.00 | $ 22,198.87 |

2013 | 32.4 | $ 5,500.00 | $ 18,443.17 |

2014 | 13.7 | $ 5,500.00 | $ 16,220.91 |

2015 | 1.4 | $ 5,500.00 | $ 15,996.95 |

2016 | 11.9 | $ 5,500.00 | $ 14,295.76 |

2017 | 21 | $ 6,000.00 | $ 12,888.74 |

2018 | -5.2 | $ 6,000.00 | $ 13,595.71 |

2019 | 18.4 | $ 6,000.00 | $ 11,482.87 |

2020 | 28.7 | $ 6,500.00 | $ 9,665.71 |

2021 | -18.1 | $ 7,000.00 | $ 12,709.68 |

2022 | 16.3 | $ 7,000.00 | $ 10,928.36 |

2023 | 25.7 | $ 7,000.00 | $ 8,694.00 |

2024 | 24.2 | $ 7,000.00 | $ 7,000.00 |

| Total | $ 130,500.00 | $ 494,320.25 |

Last edited:

The Roth IRA effect ...

... <snip>

We started our older daughter - who is nearly 19 now - in a Roth account when she earned a few hundred bucks in a school internship 3 summers ago. She worked as a lifeguard last summer and earned a couple of thousand. She has done some behind the scenes work for TideFans, as well. The Bank of Daddy matched her earnings into her checking/savings account and she then contributed all of her earnings each of those years into a Roth and now has a sizeable jump on saving for retirement and can see tangible results of saving/investing for retirement that she will hopefully continue herself as she matriculates toward graduation and a career. Also, she's currently on a full tuition scholarship at a Top 20 university so all of the excess $ (up to $35K) we will have saved for her college costs in a 529 plan can be converted into her Roth after graduation in a few years. But it all starts with saving early and often - something we didn't do early and now have to do often

... <snip>

Did the exact same thing for our daughter several years ago. I have matched her earnings every year and plan to do so until she is out of school and drawing a full paycheck.

My hope is the same as yours; give her a solid foundation, plus teach her how to build on that foundation, to produce a comfortable cushion on which she can retire to.

She spent her first year at university at one of their European campuses, before a couple years in the States. Now she is finishing her senior year back on the European campus.

The cost of her schooling has been somewhat like a mortgage (front loaded), but second and third year was in-state tuition, which was the deal for going abroad her first year - would have been out-of-state, otherwise.

Her senior year, however, has cost us Zero, because she has been on staff with the school this whole year. They paid all of her expenses, including travel to and fro. That was a bonus we had not planned for. Very grateful!

Because we had a prepaid tuition plan, and we did not need to use all of it, hopefully, our plan will also be eligible to be converted into her Roth IRA. Thank you for mentioning that. I was not aware of that possibility.

New Posts

-

-

-

Braves: 1993 Atlanta Braves Retrospective: The Last Pennant Race

- Latest: selmaborntidefan

-

Trending content

Latest threads

-

Bama Game Thread: Bama vs St Johns - Sat Nov 8 - 11a -FoxSports1

- Started by CajunCrimson

- Replies: 1

-

-

ESPN: Seven seasons, four teams, three conferences: Jalen Catalon's extensive career by the numbers

- Started by TideFans Reporter

- Replies: 0

-

ESPN: Breaking down Texas Tech's tortilla toss tradition and why it's banned

- Started by TideFans Reporter

- Replies: 0

-

Housing, rent control, etc. thread

- Started by Bodhisattva

- Replies: 9

-

ESPN: Sizing up BYU-Texas Tech, A&M-Mizzou, Oregon-Iowa and 25 other key showdowns

- Started by TideFans Reporter

- Replies: 0