A couple of points.

1. I learned at the Capstone that specialization and free trade benefit both parties to a transaction. I still believe that, to a point.

2. The country best postured for autarky is the US, better than Guatemala or Columbia. But autarky hurts everyone.

3. I think all of this is a bargaining technique. Some pundit (and I cannot remember who) said Trump sees himself as a wheeler-dealer and a lot of what he says is to strengthen his bargaining position when the US sits down at the table to negotiate.

4. Tariffs would not cause inflation, it would cause prices to rise for the tariffed commodity. Two different things. Inflation is a general increase in prices as too many dollars chase too few goods. Place a tariff on coffee and the price of coffee goes up. The price of substitutes (say, tea) would also go up a bit as some folks shift from drinking coffee in the morning to drinking tea. Place a tariff on coffee and the price of steel would be unchanged.

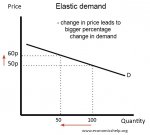

5. The incidence of a tariff depends on the price elasticity of demand for that commodity. Place a tariff on diabetic insulin and the consumer pays the entire tariff because nobody (or very few) would simply stop taking insulin. The demand of insulin is very inelastic. Place a tariff on imported cars and consumers would shift to buying American cars, so the incidence of the tariff would be born by foreign manufactures and by consumers (to a lesser extent) as the price of American-made cars goes up due to increased demand for American cars. Some would simply not buy a new car at all.

1. I learned at the Capstone that specialization and free trade benefit both parties to a transaction. I still believe that, to a point.

2. The country best postured for autarky is the US, better than Guatemala or Columbia. But autarky hurts everyone.

3. I think all of this is a bargaining technique. Some pundit (and I cannot remember who) said Trump sees himself as a wheeler-dealer and a lot of what he says is to strengthen his bargaining position when the US sits down at the table to negotiate.

4. Tariffs would not cause inflation, it would cause prices to rise for the tariffed commodity. Two different things. Inflation is a general increase in prices as too many dollars chase too few goods. Place a tariff on coffee and the price of coffee goes up. The price of substitutes (say, tea) would also go up a bit as some folks shift from drinking coffee in the morning to drinking tea. Place a tariff on coffee and the price of steel would be unchanged.

5. The incidence of a tariff depends on the price elasticity of demand for that commodity. Place a tariff on diabetic insulin and the consumer pays the entire tariff because nobody (or very few) would simply stop taking insulin. The demand of insulin is very inelastic. Place a tariff on imported cars and consumers would shift to buying American cars, so the incidence of the tariff would be born by foreign manufactures and by consumers (to a lesser extent) as the price of American-made cars goes up due to increased demand for American cars. Some would simply not buy a new car at all.

Last edited: